green card exit tax calculator

Green Card Exit Tax Abandonment After 8 Years. Each year is on the rise.

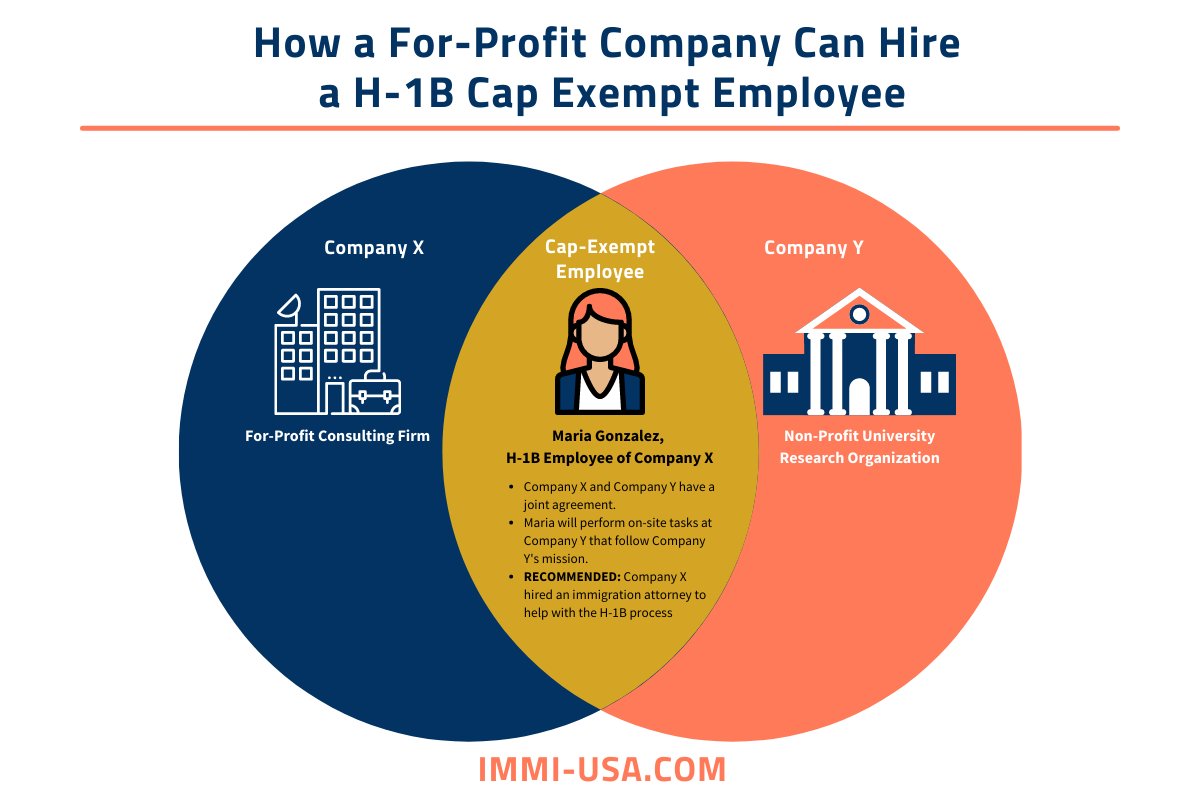

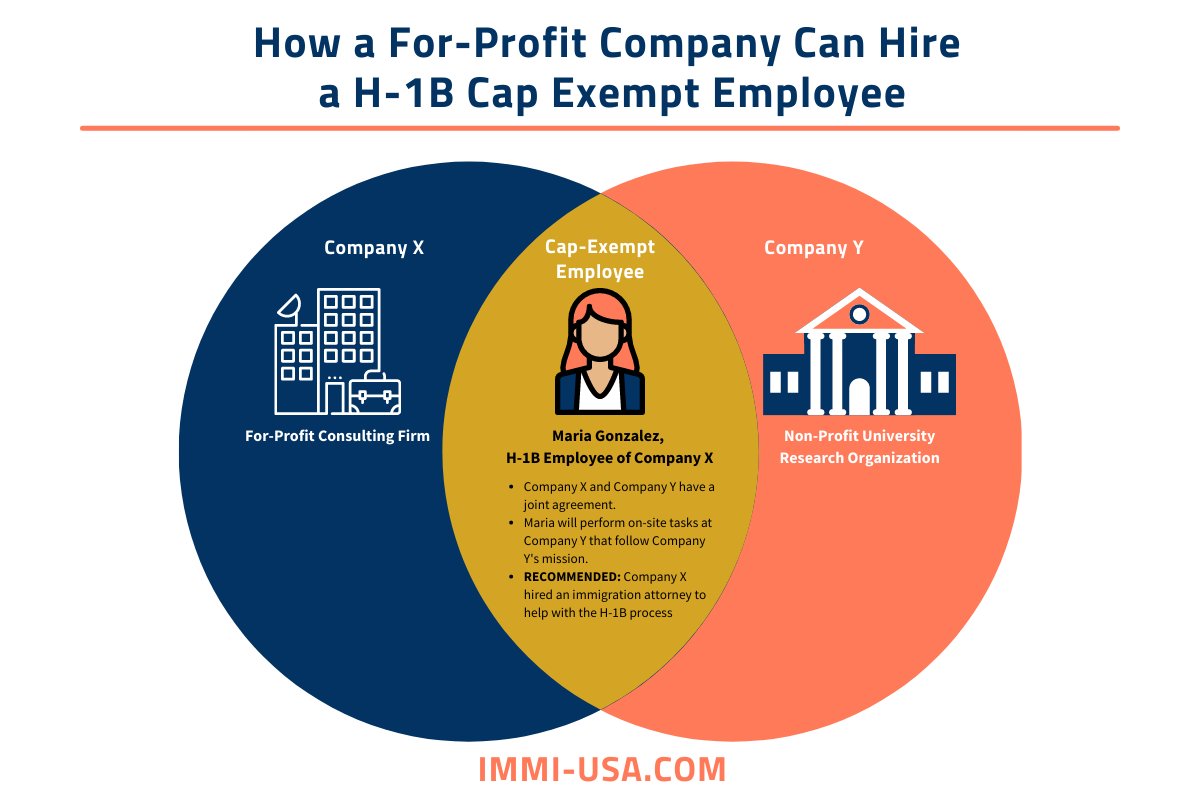

H 1b Cap Exempt Rules Employers And Process 2022 23

Exit tax is based on whether the.

. Try Our Free Tax Refund Calculator Today. Your objective as a green card holder is to avoid being a long-term resident unless you really truly want to live in the United States indefinitely. Currently net capital gains can be taxed as high as 238.

It is not just your US. These reports provide data on various aspects of your green card. The exit tax process measures income tax not yet paid and delivers a final tax bill.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card. Immigrants who hold their permanent resident visas green cards for long enough to be hit by the exit tax are called long-term residents. Having planned and executed an entry into the US.

Citizenship and Immigration Services USCIS issued you a. You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration laws of residing permanently in the United States as an immigrant. The 8-out-of-15-year test is satisfied.

Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. How the Exit Tax is calculated in general what is subject to the Exit Tax. For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000.

In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US. Ineligible deferred compensation items. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

Paying exit tax ensures your taxes are settled when you. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable. The mark-to-market tax does not apply to the following.

This is the aggregate net value of worldwide assets. Resident status for federal tax purposes. We have several calculators and tools so you can get the latest updates and information from USCIS.

The IRS Green Card Exit Tax 8 Years rules involving US. Exit Tax Expatriation Planning. For the purposes of the mark to mark rules the cost basis will be deemed to be the value of the property on the date the.

The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. You generally have this status if the US. Long-Term Resident for Expatriation.

Citizens or long-term residents. There are three. If Green Card status commenced in 2013 or earlier there is an exit charge in 2020 as.

Different rules apply according to. Persons seeking to expatriate from the US. The 8 years are.

Green Card to Long-Term Resident to Expatriate. When a person expatriates they may become subject to an Exit Tax. Current legislation regarding an exit tax was introduced relatively recently but the idea of a US exit tax has a long history of support going back at least as far as the 19th century.

A long-term resident is an individual who has held a green card in at least 8 of the prior 15 years. Exit Tax for Green Card Holders. Eligible deferred compensation items.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US. Long-term residents who relinquish their US.

It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. For married taxpayers each spouses net worth is calculated separately from the other. Citizen who relinquishes his or her citizenship and 2 any long - term resident of the United States who ceases to be a lawful permanent resident of the United States Sec.

With the ever-increasing IRS enforcement of offshore accounts compliance and foreign income reporting the number of US. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used.

Pensions earned OUTSIDE the US. Our USImmigration Calculator provides you with various categories of immigration data and statistics. The term expatriate means 1 any US.

In addition specific dates for the welcome letter and Expected Interview. AFTER becoming a US. Not everyone is taxed as they leave.

The exit tax is a tax on the built-in appreciation in the. This is known as the green card test. The Exit Tax Planning rules in the United States are complex.

877A g 2A long - term resident is an individual who is a lawful permanent resident ie a green card holder of the United. For Federal Income Tax purposes a long-term permanent resident is deemed to have disposed of hisher world-wide assets at their fair market value the day prior to the expatriation. Citizen or Green Card holder ARE subject to the Exit Tax.

My Blog My Wordpress Blog Jeux En Ligne Maternelle Vulnerabilite Bourses D Etudes

![]()

My Blog My Wordpress Blog Jeux En Ligne Maternelle Vulnerabilite Bourses D Etudes

Laws Of Exponents Power Of A Product Exponent Worksheets Math Guided Notes Exponents

Black Led Exit Sign With Green Letters Amazon Com

New Tax Regualtions Clarify Pfic Antiabuse Rules And Safe Harbors

Non Us Citizens How To Avoid Becoming A Tax Resident In The Us

Carta De Impuestos De Dibujos Animados Arrastrando Empresario

Pin By Stock Quantum On Stock Quantum Financial Analysis Investing Fundamental Analysis

Modern Buy Vs Rent Postcard Real Estate Marketing Postcards Real Estate Marketing Flyers Real Estate Postcards

My Blog My Wordpress Blog Jeux En Ligne Maternelle Vulnerabilite Bourses D Etudes

Forex Signals 105 Pips Gained By All New Webinar Attendees Itm Financial Leveraging Social Forex Signals Worldwide Forex Forex Signals Forex Financial

Non Us Citizens How To Avoid Becoming A Tax Resident In The Us

2015 Personal Tax Calculator Ey Canada Declaracion De Renta Preguntas Renta

The Tax Consequences Of Leaving Canada Permanently

Non Us Citizens How To Avoid Becoming A Tax Resident In The Us

Bts Sale 25 Off All Lesson Materials Teacher Books Integrated Learning Integrated Curriculum

Pin On International News Headline

Consigntill Easy To Use Point Of Sale Software Solution For Consignment And Resale Businesses Shopify E Commerce Business Starting A Business